Banco Sabadell

Data-driven Products & Systems

Rapid Prototyping

UX / UI Design

Information Design

Interactive Data Visualisation

Product Strategy

Full Stack Development

Data Engineering

AI & Machine Learning

Data Exploration Tool

Banco Sabadell, one of Spain’s largest financial

institutions, employs over 20,000 people and serves 12 million customers. At this size, effective management of commercial and business information is crucial for operational efficiency and service quality. Given the complexity of Banco Sabadell’s operations, tailored solutions that seamlessly integrate with the bank’s Corporate Data Ecosystem are essential to meet its needs.

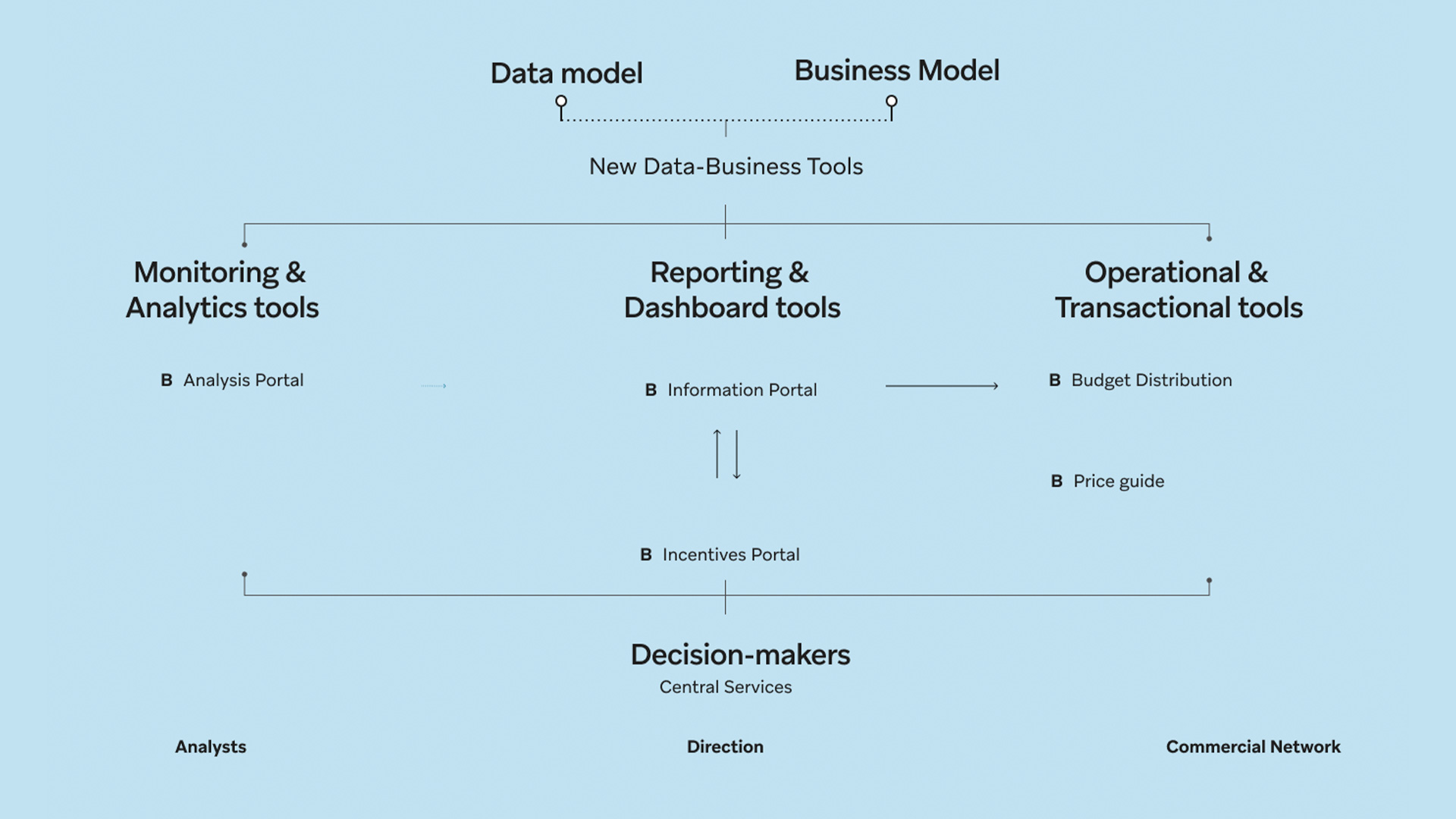

Bestiario was approached to redesign their internal information ecosystem, including solutions like the Information Portal, Incentives Portal, Price Guide, Risk Analysis Portal, and Budget Distribution.

A data-driven information ecosystem

To enhance collaboration between Banco Sabadell’s business sectors and its IT Division, we developed a comprehensive information ecosystem that incorporates key solutions such as the Information Portal, Incentives Portal, Price Guide, Risk Analysis Portal, and Budget Distribution. These tools seamlessly integrate with the bank’s Corporate Data Ecosystem, improving productivity and decision-making across departments.

Our solution reshaped the company’s relationship with data to transform the way they do business. Streamlining communication networks and enhanced access to business insights. As a result, more than 12,000 users now have simultaneous access to over 400 types of reports each day.

Our solution reshaped the company’s relationship with data to transform the way they do business. Streamlining communication networks and enhancing access to business insights. As a result, more than 12,000 users now have simultaneous access to over 400 types of reports each day.